In A Hurry? Click Here To Download This Post As A PDF To Read Later

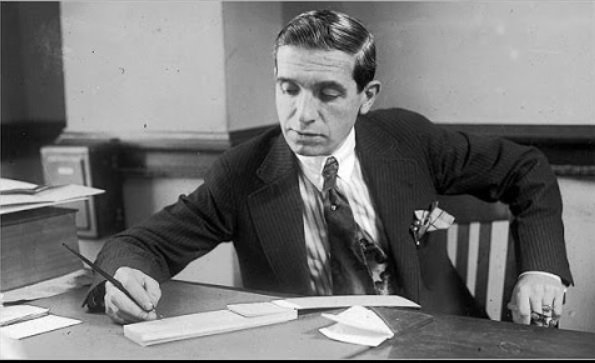

Over the years, there have been some incredibly audacious ‘money-making’ schemes hit the internet. However, none of them will ever surpass Charles Ponzi and what came to be known as the Ponzi Scheme. Despite the scheme’s widespread attention, it still gets attempted today and it’s something of which you need to be aware when spending time online.

The Basics

Originally created in the 1920s, Charles Ponzi came up with the idea of funding early investors with the money  paid by new investors. With no investment from the creator at all, a Ponzi Scheme is both a scam and illegal nowadays. At any given point in time, the scheme cannot afford to pay all members and it’s the early investors who benefit the most because they’re paid using the investment of new members; there’s actually no investing or money-making involved.

paid by new investors. With no investment from the creator at all, a Ponzi Scheme is both a scam and illegal nowadays. At any given point in time, the scheme cannot afford to pay all members and it’s the early investors who benefit the most because they’re paid using the investment of new members; there’s actually no investing or money-making involved.

If we look at some numbers, they might ask you to pay $100 and they’ll claim you can triple your money within a certain amount of time. Rather than investing it or doing anything at all with your money, they wait until two more people invest $100 and give you $300. After enjoying the return, they hope you invest more and the system grows until thousands of people are all investing $100.

The Inside Details

What is Ponzi Scheme about? Well, in truth, it has five different elements and you’ll need to know this information to prevent falling into the trap yourself.

Benefit – To start, the scheme will always start with some form of a promise that your initial investment will multiply. In the early stages, they’re trying to draw people in and they’ll normally advertise the rate at which you should expect the money to multiply. For the creators, they’re tasked with choosing a number that’s believable yet generates interest.

Setup – Next, they need to give an explanation as to how your money will be used. Often, they say the investor has some ‘inside information’ or that they’re simply skilled in the market. Although less rare, they could also explain how they have an opportunity that isn’t otherwise available to the wider public.

Credibility – Whether it’s the creator of the scheme or not, they normally have somebody running the show who can instill confidence in the would-be investors. As the face of the scheme, they build credibility and convince the investors they can transform the sum of money into something much larger.

Pay Off – For step four, the money is returned with the profit (the money of other investors) and the recipient is left feeling amazed. Instantly, they’ll want to invest more money and tell all their friends about this fantastic opportunity that’s just tripled their money in no time.

Success – Over time, the number of investors continues to grow and the scheme creators are moving around significant sums of money. For the scheme to really take hold, it needs to grow quickly so the new investors can pay for the return of the early investors.

Previous Cases

When people ask ‘what is Ponzi Scheme about?’, there’s another question that normally comes with it; ‘how big can these schemes actually get?’. Would it surprise you to learn they can reach the billions mark? Despite making an entrance to the market in the 1920s, the biggest ever Ponzi Scheme occurred in 2008.

With Bernard L Madoff at the helm, he offered all the credibility the business needed because he had been an investor since the 1960s as well as the Chairman of the Board of Directors for NASDAQ (one of the largest stock exchanges in the US). According to experts who investigated the case, the total losses of the scheme were up to $50 billion and it collapsed after clients were requesting up to $7 billion in redemptions; the liquidity simply didn’t exist to meet the obligations.

How Do They End?

For the majority of Ponzi Schemes, they fail within a few months because there isn’t enough interest to pay for the returns of the early investors. As mentioned previously, the schemes need to take off quickly so each new member contributes to the return of the oldest members. If they get a good grounding, there’s nothing to stop the scheme lasting for many years.

For the majority of Ponzi Schemes, they fail within a few months because there isn’t enough interest to pay for the returns of the early investors. As mentioned previously, the schemes need to take off quickly so each new member contributes to the return of the oldest members. If they get a good grounding, there’s nothing to stop the scheme lasting for many years.

For those offering a lower rate of return, success is actually more likely because the payments are more sustainable; it requires fewer new members to pay the returns of the oldest members. In terms of ending, there are three options they take. For most, they cut all ties with the investors and run away with whatever money they’ve

been able to obtain. At a natural point in the process where they’ve got all the money and are just about to return, they jet off, leave the country, and presumably hide until caught or for the rest of their lives.

For some Ponzi Schemes, the creator tells all investors the investment opportunity didn’t pay off and they lost their money (despite keeping it for themselves). Since this is risky and it leads to potentially thousands of unhappy investors, this isn’t normally the chosen ending. Of course, there are also schemes that are caught and broken down before the creator has a chance to run away with the money.

Leaving A Ponzi Scheme

If you’ve invested money into a scheme and now you’re worried it’s a Ponzi Scheme, the first thing you need to do is stop investing immediately. From here, go online and check the trusted lists of companies to avoid. Furthermore, you can also check if the company is registered with the appropriate bodies. If not, they should be reported as soon as possible. If you happen to get your investment back with a return, keep the money and don’t make any further investments.

Summary

As you can imagine, Ponzi Schemes are dangerous because you never know whether you’re going to get your money back and it’s also illegal to invest in this type of scheme with knowledge of how it’s operating. Alternatively, investing without realizing what’s occurring is another case entirely. In the future, we recommend steering clear of all schemes like this whether it’s a Ponzi, Pyramid, or even Cash Gifting. Although a Ponzi Scheme will pay, it only pays to a few and a significant number of members will make a loss.

In today’s world, there really is no need to invest in this type of scheme considering there are so many real opportunities to make money. If you’re looking for new methods of earning money without leaving your home, there are some superb opportunities including affiliate marketing. For example, the platform Wealthy Affiliate will help you to create a website while also teaching you everything you need to know as you progress.

What is Ponzi Scheme about? Unfortunately, it’s illegal, terrible, and potentially financially crippling. As long as you stay away from these schemes, you can be confident your money is going towards something worthwhile.

Thanks for reading, please feel free to share this information so we can put an end to something that really shouldn’t still have a place in society!